The IRS allows tax deductions and in certain cases, tax credits, to reduce the after-tax cost of purchasing and installing Flow’s ultra-efficient Answr Heat Pumps. Most tax incentives are driven by US policy to encourage the installation of efficient electric heat pumps to combat climate change in line with global undertakings made by the Montreal Protocol, the Paris Climate Accord, and the Kigali Amendment. Calvetti Ferguson partnered with Flow Environmental Systems, an environmentally responsible HVAC&R solutions company, to identify tax incentive opportunities for the installation of energy-efficient HVAC systems.

Relevant IRS-approved tax deductions are as follows:

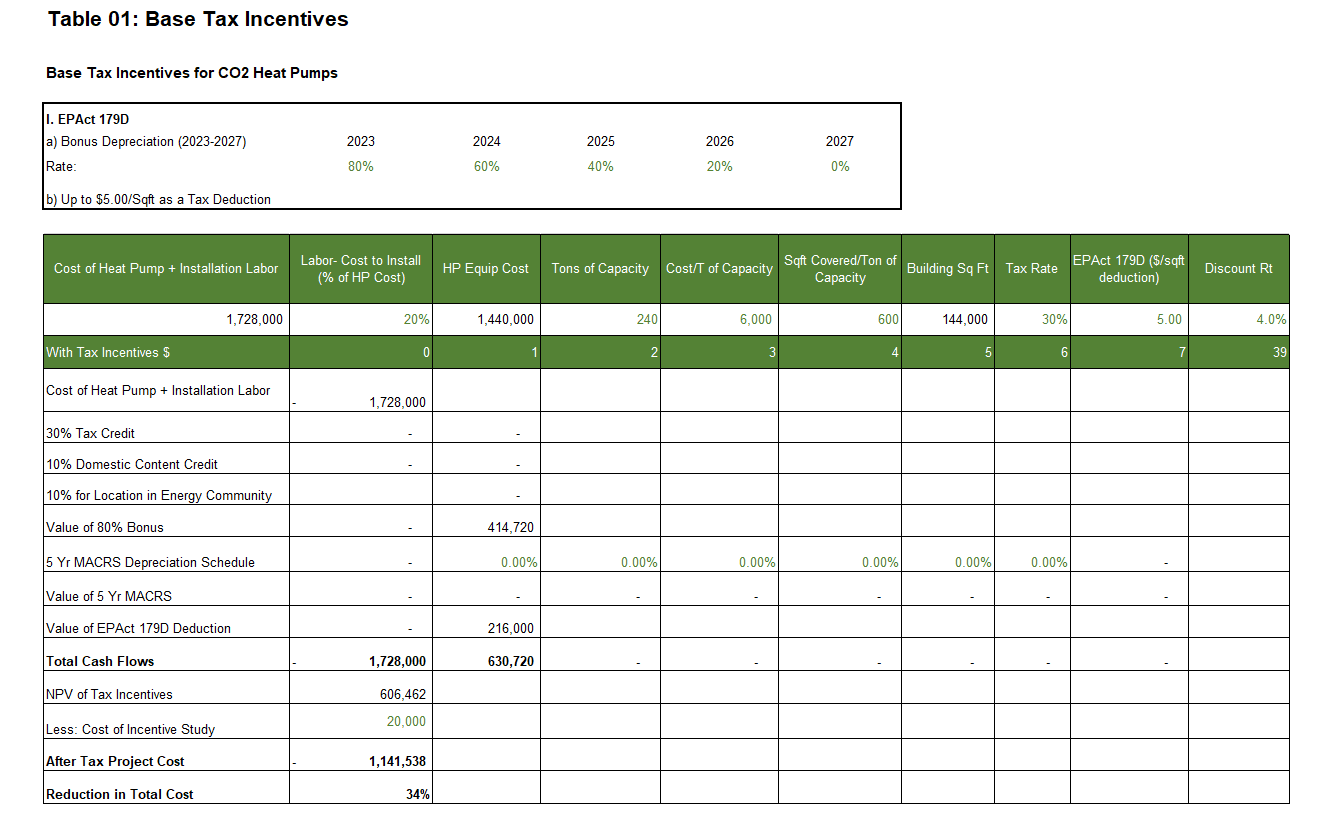

1) EPAct 179D

This includes the following:

a. Tax Provision – Energy Efficient Commercial Buildings Deduction

b. Description – Tax deduction for energy efficiency improvements to commercial buildings, including HVAC systems.

c. Eligible Recipients – Owners and long-term lessees of commercial buildings. Non-taxpaying owners may allocate tax deductions to service providers that contribute to the design process (such as architects, mechanical contractors etc.).

d. Base Deduction – $0.50-$1.00/sq ft depending on the magnitude of efficiency gains as certified by a professional engineer.

e. Bonus Deduction – $2.50-$5.00/sq ft if the project meets prevailing wage and apprenticeship requirements.

2) Bonus Depreciation

As seen below, 80% of the installed cost in 2023 is cut by 20 percentage points each year until eliminated as a special deduction in 2027. Applicable only when the equipment is reclassified into an accelerated depreciation schedule.

In the example illustrated in Table 01 where, i) Flow’s Answr provides 240T of heating and cooling for a project completed in 2023, ii) labor to install the heat pump is 20% of the equipment cost, and iii) maximum deductions are achieved (among other assumptions as noted), these tax deductions can reduce the after-tax cost of the installed heat pump by about one third.

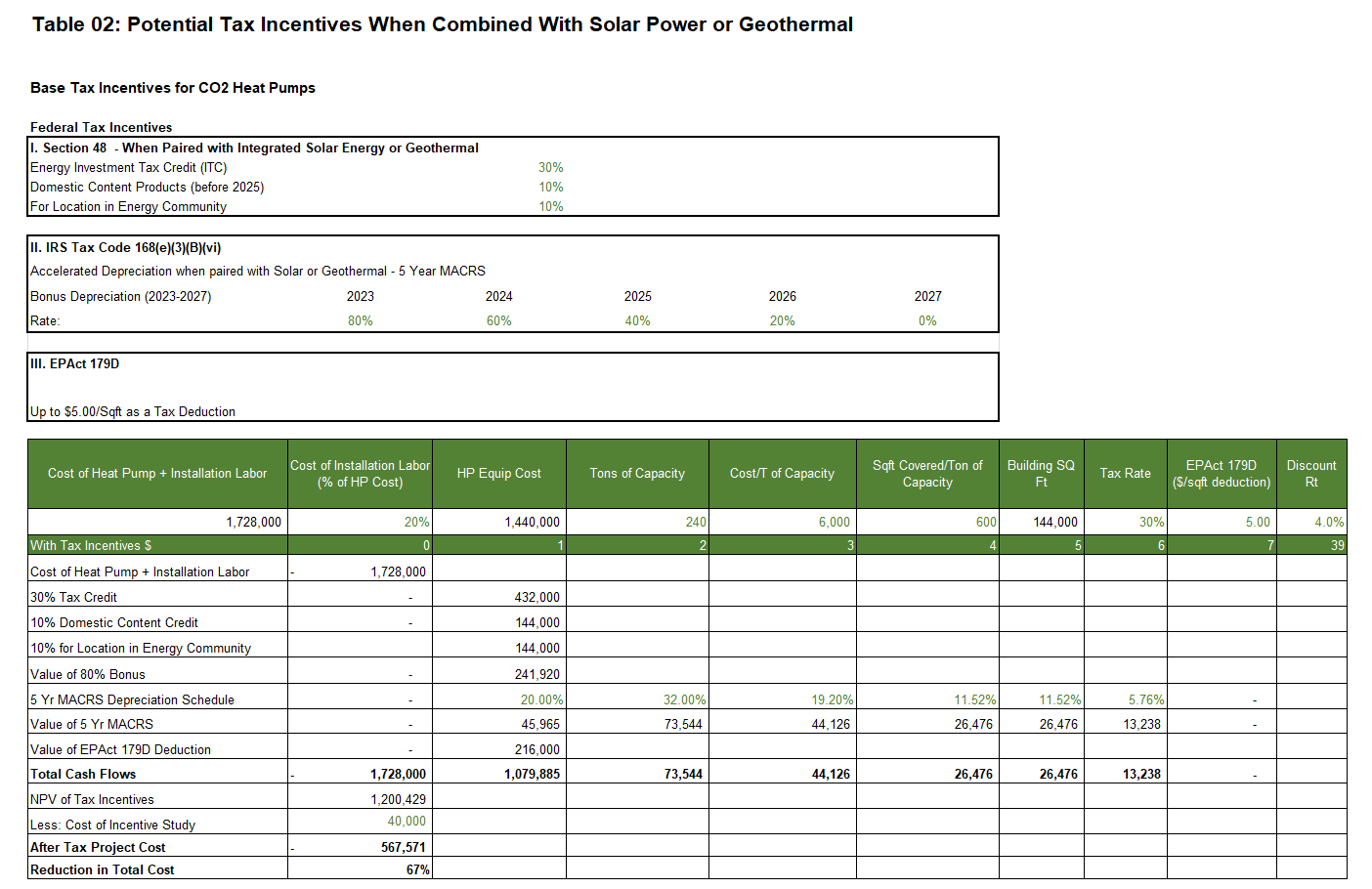

In addition to the tax deductions as described above, Section 48 tax credits and accelerated depreciation using MACRS may be claimed by building owners on costs relating to Flow’s Answr Heat Pumps if part of i) a geothermal water-sourced heat pump system or ii) an integrated project powered by solar energy.

Relevant IRS-approved tax incentives are as follows:

1) Section 48

a. Tax Provision – Investment Tax Credit for Energy Property

b. Description – Tax credit for investment in renewable energy projects. The credit includes integrated HVAC and electricity generation equipment powered by solar energy and geothermal-linked, water-sourced heat pumps.

c. Eligible Recipients – Taxpayers, government, and tax-exempt owners installing eligible energy property.

d. Base Credit Amount – 6% of qualified investment.

e. Bonus Credit Amount – 30% for projects meeting prevailing wage and registered apprenticeship requirements.

f. Add-on Credit Amount – 10% if certain domestic content requirements are met for steel, iron and manufactured products. Further credit of up to an additional 10% is given if the project is established in an energy community.

2) IRS Code 168 (e) (3) (B) (vi)

a. Tax Provision – Modified Accelerated Cost Recovery System (MACRS).

b. Description – Separates the depreciation schedule of the building (39-year asset) from the depreciation schedule of HVAC and other equipment within a building.

c. Eligible Recipients – Owners of commercial buildings where retrofits have included i) integrated solar power and heat pump system or ii) a geothermal water-sourced heat pump.

d. Base Schedule – Qualified energy property is a 5-year asset and is depreciated over 6 years per the example below.

The following table layers the above incentives onto the tax deductions illustrated in Table 01. As with the tax deductions table, the project is assumed to qualify for all bonuses and add-on credits.

As seen in Table 02, incorporating the above incentives can reduce the after-tax cost of a qualifying heat pump installation by two-thirds.

Flow teamed up with our team at Calvetti Ferguson, a nationally recognized full-service CPA firm specializing in certifying and optimizing tax incentives associated with installing efficient heat pump systems to ensure that these material savings are identified and captured.

About Flow Environmental Systems, Inc.

This article was co-authored with Navaid Burney, CFO of Flow Environmental Systems. Flow is a US-based technology, engineering, manufacturing, and distribution company bringing commercially viable and environmentally responsible HVAC&R solutions to the North American market. Its energy-efficient Answr range of commercial CO2 air and water source heat pumps generate simultaneous heating and cooling while they decarbonize commercial and multi-family buildings.

Contact Us

Calvetti Ferguson, a full-service CPA and advisory firm, specializes in real estate tax incentives such as Section 179D and the investment tax credit. Their team of industry experts will provide a complimentary assessment of your project to identify any potential tax incentive benefit. All incentive studies are a turnkey service, which includes the preparation of all necessary calculations, certifications, and documents to claim the applicable credits and deductions.