Special purpose acquisition companies (“SPACs”) are newly formed companies without any business operations. They operate as an investment vehicle, raising capital through an initial public offering (“IPO”), which is in turn held in a trust account and used to acquire a private target company (the “Business Combination”).

SPACs generally raise capital during the IPO stage by relying on the reputation of the SPAC’s sponsor (the “Sponsor”) and seeking out investment from institutional investors. The money raised in the IPO is typically about one-fifth to one-quarter of the expected enterprise value of the target to minimize the effect of dilution resulting from founder shares and warrants. As part of the offering, the SPAC will offer a unit consisting of one share and some fraction of a warrant. The warrants that are part of the unit are always struck “out of the money,” typically at $11.50. However, in some cases the exercise price may be adjusted downward if the SPAC raises capital by issuing common stock or equity-linked securities below a specified price, e.g., $9.20 per share, and certain other conditions are met (referred to as the “Crescent term” after the first offering in which it appeared). In comparison, the Sponsor will acquire founder shares for nominal consideration (generally $25,000). These typically result in the Sponsor owning 20% of outstanding common stock post-IPO. In connection with negotiation of business combination, Sponsor may agree with the seller to forfeit a portion of the founder shares or subject a portion to performance vesting. Generally, founder shares are subject to a lock-up period for one year following the business combination.

Types of SPAC IPOs

A SPAC’s IPO is typically sourced from two concurrent groups: (1) public investment from institutional investors purchasing common stock or ordinary shares, and (2) private placements where the Sponsor purchases warrants (or sometimes units or rights). In the latter instance, the proceeds are used to pay IPO expenses, plus a specified amount is held outside the trust account for future expenses. This is the ‘at-risk capital’ and it typically sits around four percent of the IPO size. A current trend is to “overfund” the trust account, where roughly 1 to 2 percent of the IPO proceeds—or $10.10 or $10.20 per share—are placed in the trust account. In this instance, the Sponsor will place the extra five percent into the trust to generate interest at the IPO stage by creating more yield, guaranteeing investor return if they seek to redeem their shares.

A key feature of SPACs is that, when investors purchase shares, those shares carry redemption rights. Upon the Business Combination, investors can elect to receive their pro rata portion of the trust account (including interest). Shareholders can also elect to redeem regardless of whether they vote for or against the Business Combination.

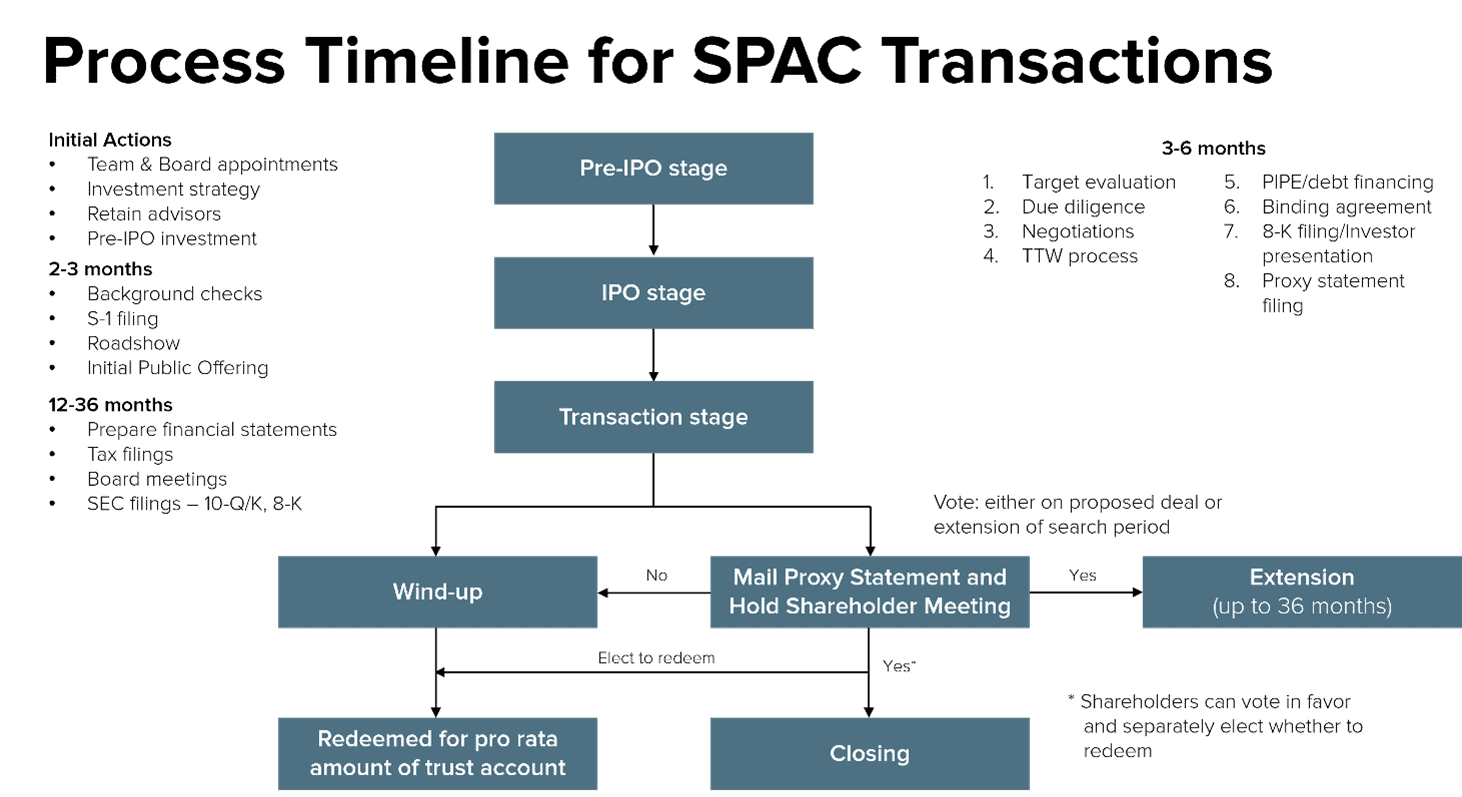

In connection with the Business Combination, a SPAC operates as an alternative to a traditional IPO since a public company—the SPAC—takes a private company public by means of a Business Combination. However, the target company must not be identified at the time of the IPO. SPACs typically have between 12 – 24 months to identify a target, however the current trend is towards a shorter range, from 12 – 15 months. Additionally, the term to complete the business combination can be extended (by up to 36 months) by the SPAC making a payment (usually $1 million dollars) into the trust.

During the Business Combination, the SPAC will obtain financing to acquire the target by means of private investment in a public entity (a “PIPE”). As the SPAC is working to complete the Business Combination, the SPAC will coordinate with placement agents to obtain subscription agreements—agreements to buy a certain number of shares—from institutional investors. Institutional investors are interested in buying in at the PIPE phase because they can conduct diligence on the business combination and decide whether they are interested in the opportunity to invest; if they are not then they walk away but are bound by confidentiality agreements.

As the Business Combination closes, shareholders vote on whether to approve the transactions and elect either to hold onto or redeem their shares. After making payments to redeeming stockholders, the cash in the trust account is released to the surviving company. And the SPAC will typically change its name to reflect the target’s identity, becoming the parent holding company of the entity.

Contact Us

Calvetti Ferguson works with middle-market companies, private equity firms, and high-net-worth individuals nationwide. Regardless of the complexity of the compliance, assurance, advisory, or accounting need, our team is ready to help you. Please complete the form below, and we will follow up with you shortly.