R&D Tax Consultants – Oklahoma City (OK)

Oklahoma City R&D Credit Experience

Calvetti Ferguson provides R&D Consulting services to Oklahoma area companies in a variety of industries. Typically, we work with those that have recently modified, changed, improved, or updated a process, method, or key software application. This often includes agriculture, architecture, engineering, food and beverage, manufacturing, electrical contractors, oil and gas, software, and technology companies. Our years of experience allow us to quickly evaluate savings potential and implement a seamless R&D tax credit study.

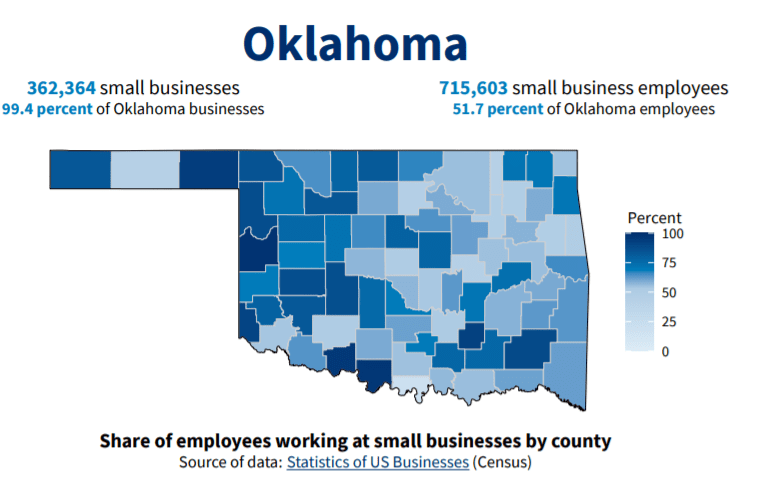

Oklahoma Small Business Profile

Oklahoma City R&D Tax Credit Process

- Phase 1: Initial Consultation and Benefit Estimate – During this initial phase, our R&D tax credit experts educate the taxpayer on the R&D tax credit and evaluate the eligibility of the company’s operations. A large part of this initial consultation revolves around the Internal Revenue Code’s 4-part test requirements of the R&D credit, and whether the company’s activities successfully meet those requirements. Key aspects discussed include company operations (historical and present), company financials, employee roles and responsibilities, major projects, project documentation, and relevant contacts.

- Phase 2: Qualification and Quantification – Once an agreement is reached, the focus turns to an investigation of the facts identified in the first phase. This often includes project interviews, quantifying related wages and expenses, and determining eligibility for the credit. Through oral interviews and review of documentation, the credit is finalized, and the appropriate tax forms are completed and made available to the taxpayer’s tax preparer.

- Phase 3: Final Report – Following the completion of the final credit figure and applicable tax forms, we may have some follow-up questions and requests, however, the bulk of the lift is out of the taxpayer’s hands. During this final phase, we prepare a final report outlining the specifics of the study process, findings, applicable regulations, and relevant documentation, figures, and exhibits. While this report is not required in advance of claiming the credit, it is an important piece of documentation to support the credit claim and it will be the first line of defense if the IRS ever audits the claim.

Oklahoma State R&D Tax Credit

Unfortunately, the state of Oklahoma does not offer a state-level R&D tax credit. However, the federal tax credit is still available to Oklahoma companies.

Map of Oklahoma City, OK

About Oklahoma City (OK)

Oklahoma City is known for its cowboy culture, oil and gas industry, and rich history. It was once a major center for cattle drives and is still considered a hub for the oil and gas industry today. The city has a diverse economy, with major industries including energy, aerospace, and healthcare. Some popular attractions in Oklahoma City include the National Cowboy & Western Heritage Museum, the Oklahoma City Museum of Art, the Myriad Botanical Gardens, and the Oklahoma City National Memorial & Museum. The city is also home to several sports teams, including the Oklahoma City Thunder (NBA) and the Oklahoma City Dodgers (MiLB).

Contact Our Oklahoma R&D Tax Credit Consultants

Calvetti Ferguson provides R&D tax credit consulting services to companies in Oklahoma City and across Oklahoma. If you are interested in learning how we can help your business, complete the form below and we will follow up promptly.