R&D Tax Consultants – Fargo, ND

Fargo business owners are constantly looking for new ways to improve profitability, reduce costs, and leverage new opportunities. In terms of cost reduction, the focus is often on operational efficiencies, production optimization, and new technology. However, many are surprised to learn about the significant savings opportunity available through the Research & Development (R&D) tax credit. The credit provides a dollar-for-dollar reduction of federal tax liability for qualifying activities. Unfortunately, many Texas companies miss out on millions in savings due to the misconception the credit is only for large companies with formal R&D functions. This is not true, in fact, many businesses already qualify for the credit based on current business activities.

Fargo R&D Credit Experience

Calvetti Ferguson provides R&D Consulting services to North Dakota area companies in a variety of industries. Typically, we work with those that have recently modified, changed, improved, or updated a process, method, or key software application. This often includes agriculture, architecture, engineering, food and beverage, manufacturing, electrical contractors, oil and gas, software, and technology companies. Our years of experience allow us to quickly evaluate savings potential and implement a seamless R&D tax credit study.

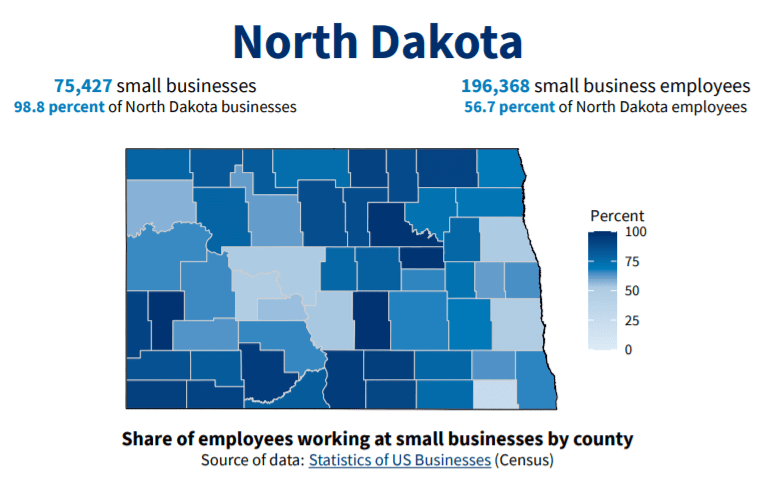

North Dakota Small Business Profile

Fargo R&D Tax Credit Process

- Phase 1: Initial Consultation and Benefit Estimate – During this initial phase, our R&D tax credit experts educate the taxpayer on the R&D tax credit and evaluate the eligibility of the company’s operations. A large part of this initial consultation revolves around the Internal Revenue Code’s 4-part test requirements of the R&D credit, and whether the company’s activities successfully meet those requirements. Key aspects discussed include company operations (historical and present), company financials, employee roles and responsibilities, major projects, project documentation, and relevant contacts.

- Phase 2: Qualification and Quantification – Once an agreement is reached, the focus turns to an investigation of the facts identified in the first phase. This often includes project interviews, quantifying related wages and expenses, and determining eligibility for the credit. Through oral interviews and review of documentation, the credit is finalized, and the appropriate tax forms are completed and made available to the taxpayer’s tax preparer.

- Phase 3: Final Report – Following the completion of the final credit figure and applicable tax forms, we may have some follow-up questions and requests, however, the bulk of the lift is out of the taxpayer’s hands. During this final phase, we prepare a final report outlining the specifics of the study process, findings, applicable regulations, and relevant documentation, figures, and exhibits. While this report is not required in advance of claiming the credit, it is an important piece of documentation to support the credit claim and it will be the first line of defense if the IRS ever audits the claim.

North Dakota– State R&D Tax Credit

The state of North Dakota offers an R&D tax credit for eligible research activities. The details may vary from the federal R&D tax credit.

Map of Fargo, ND

About Fargo, ND

The narrative of the Fargo Business Community is one of resilience, collaboration, and adaptability. Historically rooted in industries such as agriculture and manufacturing, Fargo has transformed into a diverse and forward-thinking business ecosystem that embraces innovation and technology.

A defining characteristic of the Fargo Business Community is its close-knit nature. Business owners, professionals, and community leaders actively collaborate and support one another, fostering an environment of mutual success. This culture of collaboration is reinforced through regular networking events, business associations, and shared workspace initiatives, allowing individuals to connect, share knowledge, and form meaningful partnerships.

The community takes pride in its entrepreneurial spirit, which is nurtured through various resources and support systems. Fargo boasts a robust ecosystem of business incubators, accelerators, and mentorship programs, providing aspiring entrepreneurs with the tools and guidance they need to start and scale their ventures. This supportive infrastructure has been instrumental in fueling the growth of numerous successful startups and attracting talent to the area.

Contact Our North Dakota R&D Tax Credit Consultants

Calvetti Ferguson provides R&D tax credit consulting services to companies in Fargo and across North Dakota. If you are interested in learning how we can help your business, complete the form below and we will follow up promptly.