R&D Tax Consultants – Cleveland (OH)

Cleveland R&D Credit Experience

Calvetti Ferguson provides R&D Consulting services to Ohio area companies in a variety of industries. Typically, we work with those that have recently modified, changed, improved, or updated a process, method, or key software application. This often includes agriculture, architecture, engineering, food and beverage, manufacturing, electrical contractors, oil and gas, software, and technology companies. Our years of experience allow us to quickly evaluate savings potential and implement a seamless R&D tax credit study.

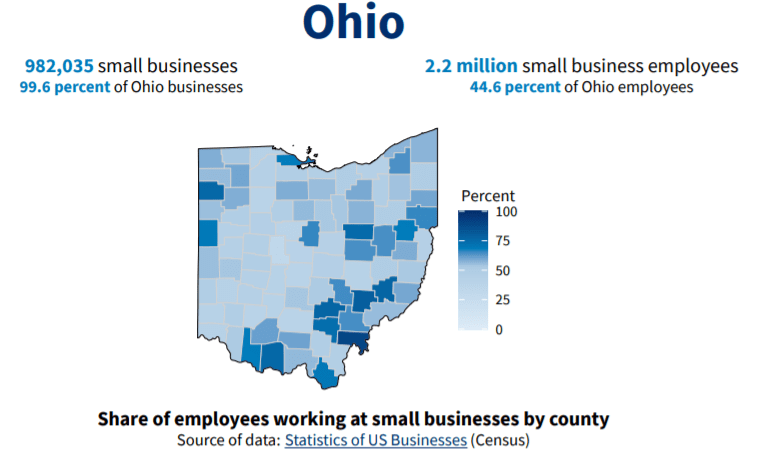

Ohio Small Business Profile

Cleveland R&D Tax Credit Process

- Phase 1: Initial Consultation and Benefit Estimate – During this initial phase, our R&D tax credit experts educate the taxpayer on the R&D tax credit and evaluate the eligibility of the company’s operations. A large part of this initial consultation revolves around the Internal Revenue Code’s 4-part test requirements of the R&D credit and whether the company’s activities successfully meet those requirements. Key aspects discussed include company operations (historical and present), company financials, employee roles and responsibilities, major projects, project documentation, and relevant contacts.

- Phase 2: Qualification and Quantification – Once an agreement is reached, the focus turns to investigating the facts identified in the first phase. This often includes project interviews, quantifying related wages and expenses, and determining eligibility for the credit. The credit is finalized through oral interviews and documentation review, and the appropriate tax forms are completed and made available to the taxpayer’s tax preparer.

- Phase 3: Final Report – Following the completion of the final credit figure and applicable tax forms, we may have some follow-up questions and requests; however, the bulk of the lift is out of the taxpayer’s hands. During this final phase, we prepare a final report outlining the specifics of the study process, findings, applicable regulations, and relevant documentation, figures, and exhibits. While this report is not required before claiming the credit, it is an important piece of documentation to support the credit claim, and it will be the first line of defense if the IRS ever audits the claim.

Ohio – State R&D Tax Credit

The state of Ohio offers an R&D tax credit for eligible research activities. The details may vary from the federal R&D tax credit.

Map of Cleveland, OH

About Cleveland (OH)

Cleveland is known for its industrial heritage, as it was a major manufacturing center during the 19th and 20th centuries. Today, the city is home to a diverse economy, with major industries including healthcare, finance, and tourism. Cleveland is also known for its vibrant arts and culture scene, with numerous museums, galleries, theaters, and music venues. Some popular attractions in Cleveland include the Rock and Roll Hall of Fame, the Cleveland Museum of Art, the Cleveland Metroparks Zoo, the Cleveland Botanical Garden, and the West Side Market. The city also has a number of sports teams, including the Cleveland Browns (NFL), the Cleveland Cavaliers (NBA), and the Cleveland Indians (MLB).

National Reach

We also provide federal R&D tax credit consulting services to companies in Boston (MA), Chicago (IL), Los Angeles (CA), Houston (TX), New York (NY), Philadelphia (PA), Phoenix (AZ), Indianapolis (IN), Charlotte (NC), Seattle (WA), Atlanta (GA), and Denver (CO).

Contact Our Ohio R&D Tax Credit Consultants

Calvetti Ferguson provides R&D tax credit consulting services to companies in Cleveland and across Ohio. If you are interested in learning how we can help your business, complete the form below and we will follow up promptly.