Today the president signed and put into law the Inflation Reduction Act of 2022. For commercial building owners, designers, and contractors this is a reason to celebrate as the Section 179D – Energy Efficient Commercial Buildings Deduction is now more powerful than ever. Calvetti Ferguson has outlined below some of the biggest changes that were enacted and how they will impact eligible taxpayers.

Maximum Deduction Increase to $5 Per Square Foot

The biggest and most beneficial change to Section 179D is the increased maximum deduction to $5 per square foot. This update increased the value over 150% from the maximum $1.88 per square foot for properties placed into service in 2022. To qualify for the $5 per square foot maximum rate, prevailing wage and apprenticeship requirements must be met. If these requirements are not met, the maximum deduction drops to $1 per square foot.

Additional Tax-Exempt Entities Can Now Allocate

The previous rules of Section 179D specified that only government building owners could allocate the deduction to designers of their buildings. This has now been expanded to include other tax-exempt entities. The code outlines that Indian tribal governments, Alaska Native Corporations, and other tax-exempt organizations may allocate the Section 179D deduction to designers of their buildings. Other tax-exempt organizations that can now allocate the Section 179D may include religious, educational, and athletic organizations, as well as many others. This will immensely expand the tax savings opportunity for the design and construction industry.

Change in Deduction Calculation Methodology

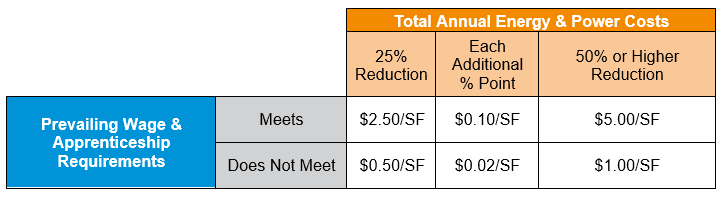

Along with the increased maximum deduction, the calculation method for the deduction value has been revamped, eliminating the $0.60 per square foot partial deduction. A sliding scale calculation has replaced the old method, allowing for more benefits to go back to the taxpayer if the maximum deduction is not achieved. The table below breaks out the new calculation methodology.

Contact Us

It is important to partner with a trusted provider when it comes to Section 179D and other technical tax incentives. Calvetti Ferguson has both licensed CPAs and Professional Engineers on staff with the knowledge and experience to capture these benefits. If you are interested in learning more about how your company can qualify for Section 179D, please fill out the form below.