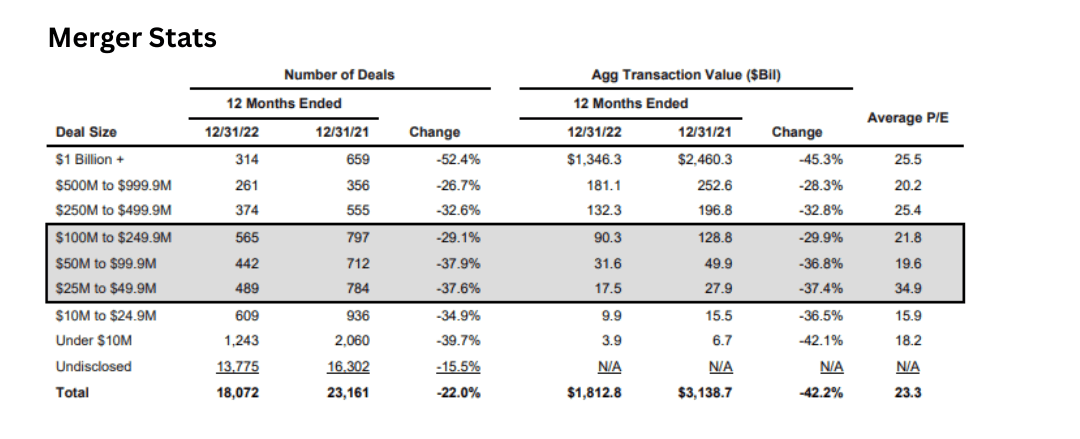

With the new year well underway, “What will middle market M&A look like in 2023?“ is a question for many buyers and sellers alike. Heavily impacted by macroeconomic factors, mergers and acquisitions in 2022 fell 58% from a peak of 2,717 transactions in December 2021 to 1,137 transactions in November 2022, according to Factset.com. The decline was not overnight but rather a steady decrease in M&A volume throughout 2022. Year-over-year changes by deal size also confirm the reduction in M&A activity between 2021 to 2022.

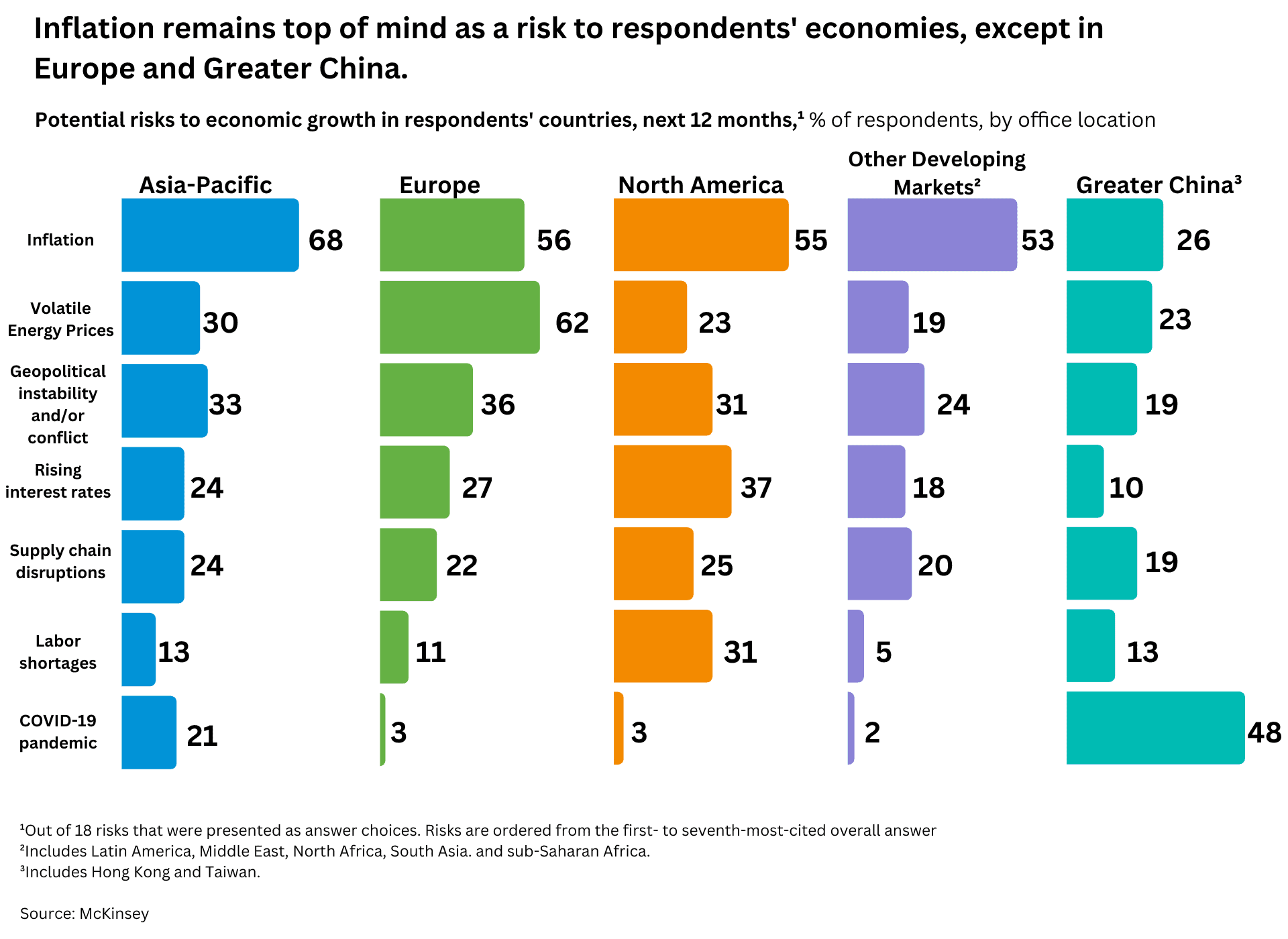

Many are asking, “How low can M&A go?” The lowest volume of M&A deal activity in recent years was around Q2 2020, after the fallout of COVID-19. The lowest deal volume occurred in April 2020 and May 2020, with 606 and 656 M&A deals, respectively, closing for each month, according to Factset.com. Barring another COVID-19 or similar crisis, it is unlikely to observe such anemic levels of deal activity for some time. However, have we reached the low point for M&A activity? It all depends on the Federal Reserve and its interest rate policy. Mix in global inflation risks, volatile energy prices, geopolitical instability (i.e., the Russian/Ukraine War), and M&A markets still have more macroeconomic contingencies to watch out for in 2023.

Although the data shows lower overall M&A activity, anecdotally, we still see deals with strong economics in the lower middle market continuing to move forward. With US Private Equity Dry Powder estimates topping $1.1 trillion, plenty of capital is needed to find a home.

In the United States, with economic headwinds caused by inflation, the Federal Reserve has increased the Fed Funds Rate to its highest levels since 1994/1995, almost 30 years ago. With inflation at 6.5% as of December 2022 (a peak of 9.1% occurred in June 2022), well above the Federal Reserve’s long-standing target of 2% inflation, interest rates are expected to continue to increase during 2023. Prevailing interest rates for businesses and consumers are impacted by an increase in borrowing interest rates stemming from an increase in the Fed Funds Rate. As of January 2022, the target Fed Funds Rate was 0% to .25%, but as of December 2022, the target Fed Funds Rate was 4.25% to 4.5%.

As interest rates rise, borrowing becomes more expensive for businesses and consumers. As borrowing becomes more expensive, businesses and consumers have less purchasing power and thus purchase fewer goods and services, which equals lower demand, decreasing inflationary pressures. The concern is that if the Federal Reserve takes interest rates up too high, the lower demand may result in a recession. A recession is defined as a significant, widespread, and prolonged downturn in economic activity, commonly measured by having a fall in GDP for two consecutive quarters. Today, the Federal Reserve is trying to orchestrate a “soft landing” where we have a slowdown in the US economy without falling into a recession. If the economy slows down, inflationary pressures ease.

How Much Higher Can The Federal Reserve Increase The Target Fed Funds Rate?

In 1994, then Federal Reserve Chief, Alan Greenspan, orchestrated the most recent “soft landing,” as discussed in an article from Bloomberg. Faced with an overheated economy and expectations of inflation taking hold in the US Economy, in 1994, the Federal Reserve increased the Fed Funds rate from 3.05% to 6.05%. This doubling of the Fed Funds rate staved off inflation and stabilized the US Economy.

As we see in January 2023, tapering inflation month over month, the Federal Reserve policy of increasing the Fed Funds rate is working. However, the Federal Reserve is likely not done raising interest rates. It is expected that the Federal Reserve will increase the target Fed Funds rate to 5% to 5.25% in 2023 with quarterly increments of .5% initially down to .25% later in the year if inflation continues its downward trajectory. The current Fed Funds Rate is lower than the 1994/1995 Fed Funds rate of 6.05%.

When Will M&A Activity Increase Again?

The signal of stability in the M&A market will start once we see stability in the target Fed Funds rate. Once the target Fed Funds rate stops increasing, we can breathe a sigh of relief that the worst is behind us. However, this alone may not bring M&A deal activity back to peak 2021 levels. For M&A, increasing interest rates directly and indirectly negatively affect debt and equity returns. Stability in interest rates will help M&A deals that go to market see more clarity to close as economics for deal funding stabilize.

The signal for growth in M&A deal flow will likely occur when the Federal Reserve begins to lower the target Fed Funds rate. After we see stability from the Federal Reserve, the next challenge will be bridging valuation expectations between buyers and sellers. The new stability will create new valuation thresholds to meet investment return expectations for buyers.

According to a recent McKinsey survey, it is still important to note that the top three international economic risks of inflation, energy prices, and geopolitical instability remain concerns over the next 12 months. Should these risks materialize into financial pressures, they may or may not be solved using the monetary and fiscal policies of the Federal Reserve alone.

Contact Us

Calvetti Ferguson works with middle market companies, private equity firms, and high net worth individuals across the country. Regardless of the complexity of the compliance, assurance, advisory or accounting need, our team stands ready to assist you. Please complete the form below, and we will follow up with you shortly.