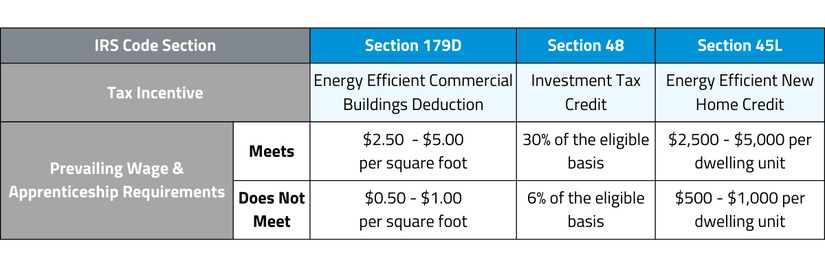

The Inflation Reduction Act passed in 2022, enhanced many green and renewable energy tax incentives, incentivizing the implementation of energy efficiency projects. This act has dramatically increased the value of many tax incentives, such as Section 179D – Energy Efficient Commercial Buildings Deduction, Section 45L – Energy Efficient New Homes Credit, and Section 48 – Investment Tax Credit for Energy Property. These energy projects must meet the new prevailing wage and apprenticeship requirements to capture the increased value.

What are the Prevailing Wage and Apprenticeship Requirements?

The prevailing wage requirements outline that all laborers and mechanics performing construction, alteration, or repair for an eligible project must be paid at least the prevailing wage. The prevailing wage is the combination of the basic hourly wage rate and any extra benefits paid to workers. The specific wage requirements are unique to the classification of laborer or mechanic and the location of the work.

The apprenticeship requirement outlines that a certain amount of the total labor hours must be performed by apprentices from qualified apprenticeship programs. The trades that must include apprentices are determined by the number of laborers and mechanics employed on the project.

The prevailing wage and apprenticeship requirements must be satisfied for most of the enhanced credits and deductions introduced by the IRA. If not, the value defaults to the standard rate, typically only 20% of the increased incentive value.

Who is Subjected to the Prevailing Wage and Apprenticeship Requirements?

The prevailing wage and apprenticeship requirements only apply if the taxpayer pursues the bonus credit/deduction amounts. These requirements apply to any construction, alteration, or repair at a qualified facility and include all laborers and mechanics employed by the building owner, contractors, and subcontractors.

Exceptions to Prevailing Wage and Apprenticeship Requirements

The prevailing wage and apprenticeship requirements do not apply to the bonus incentive amounts if construction on the project began before January 29, 2023, and has not experienced a significant pause. In addition, projects eligible for the Investment Tax Credit only need to meet these requirements if the project generates more than 1 megawatt of energy.

A good faith effort exemption for the apprenticeship requirement can also be claimed if the taxpayer cannot get the necessary qualified apprentices on the project. The IRS requires documentation to substantiate that effort was made to contract these resources.

Range of Credits/Deductions

How Can Calvetti Ferguson Help?

Establishing best practices and procedures for the new prevailing wage and apprenticeship requirements is essential. Calvetti Ferguson has the knowledge and experience to handle complicated IRS regulations. Calvetti Ferguson provides specialty tax credit consulting and can help ensure the best tax savings solution for your organization.

Contact Us

Calvetti Ferguson works with middle-market companies, private equity firms, and high-net-worth individuals nationwide. Regardless of the complexity of the compliance, assurance, advisory, or accounting need, our team is ready to help you. Please complete the form below, and we will follow up with you shortly.