For a building to achieve a Section 179D tax deduction, energy analysis is conducted for the eligible systems that were impacted in the construction project. This analysis can be performed on any combination of the three eligible systems; HVAC and hot water, interior lighting, and building envelope (roof/walls/windows).

In summary, the analysis compares the annual energy costs of a proposed building and the annual energy costs of a reference building to determine the percentage of annual energy cost savings. The resulting percentage of savings determines the dollars-per-square-foot deduction rate that will be applied to the building.

Proposed Building: A 3D energy model of the building that reflects the newly installed energy-efficient commercial building property (EECBP).

Reference Building: A 3D energy model of the building that meets the minimum requirements of ASHRAE 90.1, the energy standard for buildings except for low-rise residential buildings.

Calculation:

Annual Energy Costs Annual Energy Costs

Annual Energy Costs

Annual Energy Cost Savings

The $/SF deduction rate is calculated differently based on when construction was completed for the building. Below we have broken down the methods of calculation.

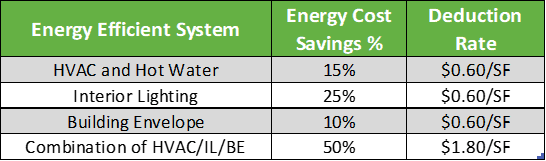

Properties Placed-In-Service in Tax Year 2022 and Prior:

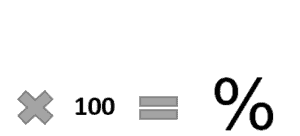

Different energy modeling analyses can achieve a partial or full deduction rate. IRS Notice 2012-26 outlines the energy cost savings percentage that must be met to achieve a $1.80/SF deduction rate and the energy cost savings percentage that must be met per system to achieve a $0.60/SF deduction rate. Any combination of these analyses can be pursued as long as the total deduction rate for the building does not exceed $1.80/SF.

For properties placed into service in 2021 and 2022, an inflation adjustment is added to the deduction rates above.

Example:

A new 105,000-square-foot building is placed in service in August of 2020.

Properties Placed-In-Service in Tax Year 2023 and Later:

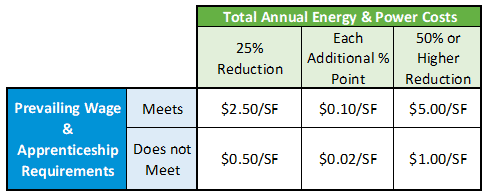

The Inflation Reduction Act of 2022 updated the calculation methodology for properties placed in service in tax years 2023 and later. Any combination of energy-efficient systems must hit a minimum of 25% annual energy cost savings to achieve a deduction rate. This rate increases on a linear basis for every 1% of savings achieved above the 25% threshold, up to 50% annual energy cost savings. The deduction rate achieved depends on whether the project meets prevailing wage and apprenticeship requirements, as outlined by the tax code.

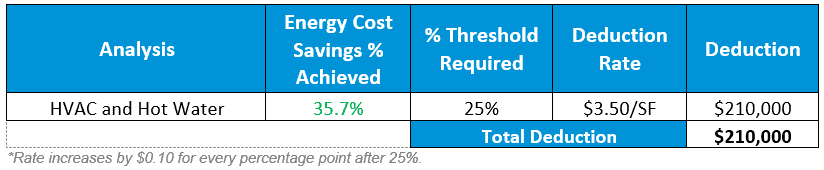

Example:

A 60,000-square-foot manufacturing facility completed a renovation to the HVAC and Hot Water system in July of 2023. The prevailing wage and apprenticeship requirements were met at this facility.

Contact us

Calvetti Ferguson has licensed CPAs and professional engineers who can guide you through the entire Section 179D process. Unlike other firms, we have tax and design industry expertise and can provide tax planning services while reducing your tax liability through this powerful incentive. We work with all sizes and types of firms and are ready to assist you and your clients.