Merger and Acquisition Trends from 2019

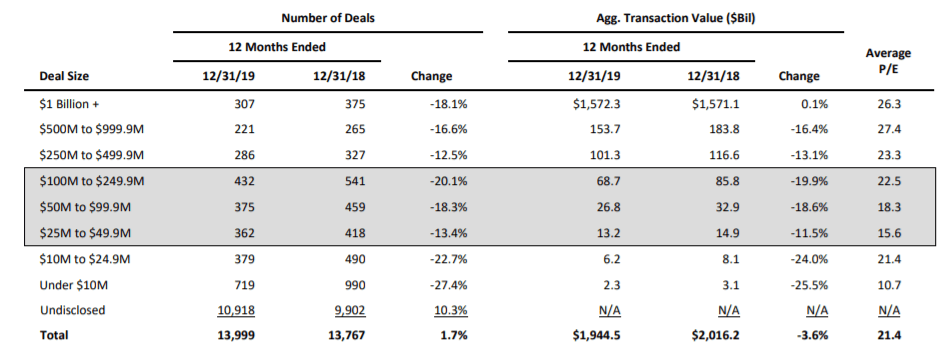

As we closed 2019, headwinds from U.S. politics, impeachment, international trade, and the economic outlook for 2020 appear to have driven more uncertainty into Middle Market M&A activity. Due to this uncertainty, as well as other factors, overall deal volume decreased in 2019 Middle Market M&A compared to 2018.1

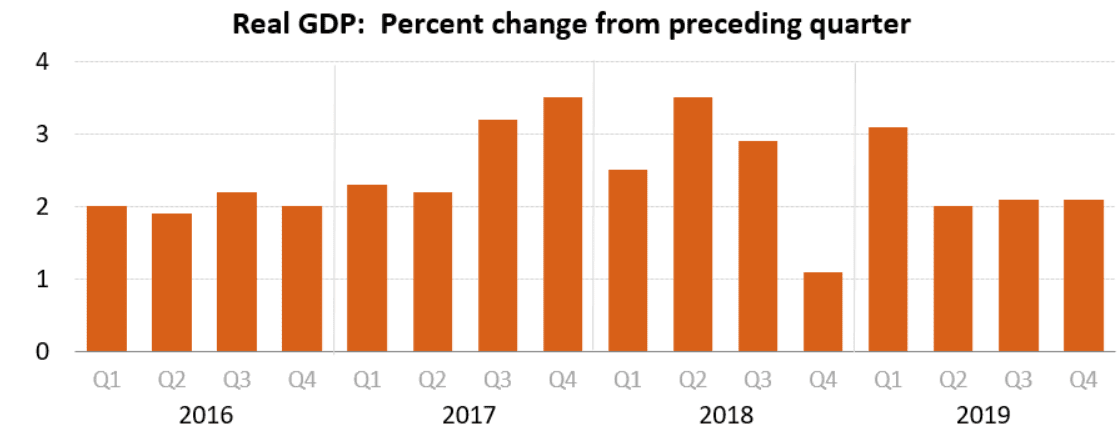

As 2019 M&A activity appears to have been all doom and gloom, this is in stark contrast to a steadily growing U.S. economy. The U.S. gross domestic product (GDP) grew at a very steady 2.1% for the last three quarters of 2019.2

Meanwhile, the S&P 500 was up 28.9% for 2019 and the Nasdaq was up 35.2%, both with the best one-year performance in six years.3 What does this mean for U.S. Middle Market M&A activity in 2020? We may potentially see robust Middle Market M&A activity in the first half of 2020.

When public equity markets are posting record high performances, in the future, investors will find it more difficult to squeeze out incremental returns from already high values.

At the same time, there has been record amounts of capital available from private investors. According to Preqin, there is an estimated $1.5 trillion of dry powder from private investors sitting on the sidelines at the end of 2019. This is the highest on record and more than double what it was five years ago.4 This capital wants to find a home where return on investment (ROI) and the investment thesis is confirmed. Although it can vary from fund to fund, typical private equity investments have hold periods of 5 to 10 years. This means fund managers must deploy their dry powder in order to begin building potential returns. With an abundant supply of capital demanding investments and fewer deals in the market at the beginning of 2020 compared to the same period in 2019, we may see increased deal values as dry powder from private equity chasing deals may drive valuations higher.

Expectations for 2020 Merger and Acquisitions

What happens when you combine steady economic growth with increased available capital chasing fewer deals? We may see increased valuations in the near term which may likely drive more new deals into Middle Market M&A as we advance into 2020. However, we must not forget 2020 is an election year and we get closer to election day, we may see M&A deal flow begin to slow down until the uncertainty of election day, as well as other factors, passes.

For additional information, click here to contact us.

Sources: 1 Factset January 2020 2 U.S. Bureau of Economic Analysis 3 Imbert, Fred, “Stocks post best annual gain in 6 years with the S&P 500 surging more than 28%” CNBC.com, December 31, 2019 4 Rooney, Kate, “Private equity’s record $1.5 trillion cash pile comes with a new set of challenges” CNBC.com, January 3, 2020

Contact Us

Calvetti Ferguson works with middle-market companies, private equity firms, and high-net-worth individuals nationwide. Regardless of the complexity of the compliance, assurance, advisory, or accounting need, our team is ready to help you. Please complete the form below, and we will follow up with you shortly.