R&D Tax Consultants – Dallas (TX)

Dallas business owners are constantly looking for new ways to improve profitability, reduce costs, and leverage new opportunities. In terms of cost reduction, the focus is often on operational efficiencies, production optimization, and new technology. However, many are surprised to learn about the significant savings opportunity available through the Research & Development (R&D) tax credit. The credit provides a dollar-for-dollar reduction of federal tax liability for qualifying activities. Unfortunately, many Texas companies miss out on millions in savings due to the misconception the credit is only for large companies with formal R&D functions. This is not true, in fact, many businesses already qualify for the credit based on current business activities.

Texas R&D Credit Experience

Calvetti Ferguson provides R&D Consulting services to Dallas area companies in various industries. Typically, we work with those that have recently modified, changed, improved, or updated a process, method, or critical software application. This includes agriculture, architecture, engineering, food and beverage, manufacturing, electrical contractors, oil and gas, software, and technology companies. Our years of experience allow us to quickly evaluate savings potential and implement a seamless R&D tax credit study.

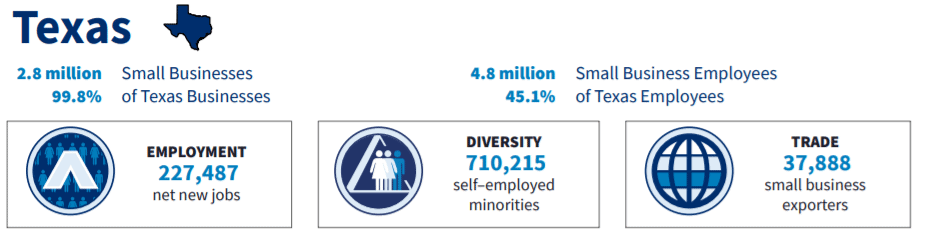

Texas Small Business Profile

Dallas R&D Tax Credit Process

- Phase 1: Initial Consultation and Benefit Estimate – During this initial phase, our R&D tax credit experts educate the taxpayer on the R&D tax credit and evaluate the eligibility of the company’s operations. A large part of this initial consultation revolves around the Internal Revenue Code’s 4-part test requirements of the R&D credit, and whether the company’s activities successfully meet those requirements. Key aspects discussed include: company operations (historical and present), company financials, employee roles and responsibilities, major projects, project documentation, and relevant contacts.

- Phase 2: Qualification and Quantification – Once an agreement is reached, the focus turns to investigating the facts identified in the first phase. This often includes project interviews, quantifying related wages and expenses, and determining eligibility for the credit. The credit is finalized through oral interviews and documentation review, and the appropriate tax forms are completed and made available to the taxpayer’s tax preparer.

- Phase 3: Final Report – Following the completion of the final credit figure and applicable tax forms, we may have some follow-up questions and requests, however, the bulk of the lift is out of the taxpayer’s hands. During this final phase, we prepare a final report outlining the specifics of the study process, findings, applicable regulations, and relevant documentation, figures, and exhibits. While this report is not required before claiming the credit, it is an essential piece of documentation to support the credit claim and will be the first line of defense if the IRS ever audits the claim.

Texas – State R&D Tax Credit

The state of Texas offers an R&D tax credit for eligible research activities. The details may vary from the federal R&D tax credit.

Map of Dallas, TX

About Dallas (TX)

Dallas is known for its modern architecture, rich history, and vibrant arts and culture scene. One of the most popular tourist attractions in Dallas is the Sixth Floor Museum at Dealey Plaza, which commemorates the assassination of President John F. Kennedy. The city also has several notable museums and cultural institutions, such as the Dallas Museum of Art and the Perot Museum of Nature and Science. it is a major economic hub, with a diverse economy driven by finance, healthcare, and technology industries. The city has several Fortune 500 companies, including AT&T, ExxonMobil, and American Airlines.

National Reach

We also provide federal R&D tax credit consulting services to companies in Boston (MA), Chicago (IL), Los Angeles (CA), Houston (TX), New York (NY), Philadelphia (PA), Phoenix (AZ), Indianapolis (IN), Charlotte (NC), Seattle (WA), Atlanta (GA), and Denver (CO).

Contact Our Texas R&D Consulting Team

Calvetti Ferguson provides R&D tax credit consulting services to companies in Dallas and across Texas. If you are interested in learning how we can help your business, complete the form below and we will follow up promptly.